Colombia Puts a Tax on Carbon

In Colombia, one of the most biodiverse countries in the world, the government introduced a tax on fossil fuels of $5 USD per ton of carbon dioxide by late 2016. The regulation was set to start working in 2017.

The revenues are aimed at conservation actions and ecosystem preservation. The regulation has also developed tax breaks for clean energy generation as part of a broader tax reform sparked by a dramatic drop in oil prices. These taxes have introduced a stable source of financing for environmental protection activities. They have also created incentives for companies to engage in carbon offsetting activities.

The World Is Taxing Carbon

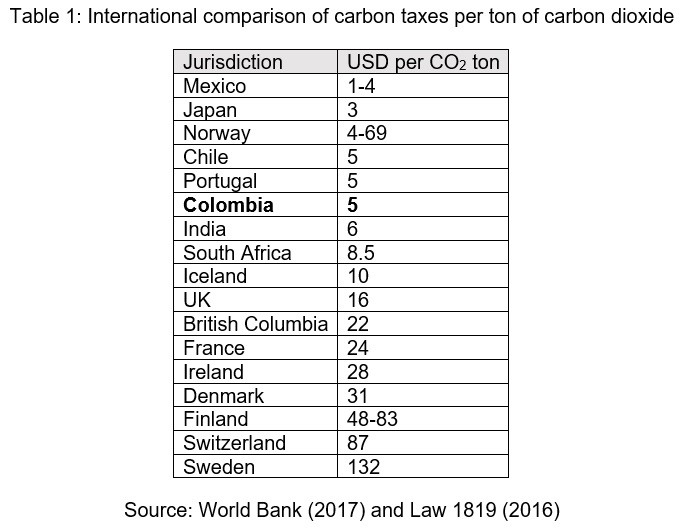

By 2017, some 24 countries had adopted or were scheduled to adopt a carbon tax in some form, according to World Bank Group’s Carbon Tax Guide. In addition, according to World Bank Group’s Carbon Pricing Dashboard platform, 51 carbon pricing initiatives have been implemented or are scheduled for implementation around the world.

Among those countries and initiatives, Colombia’s recent tax on carbon is below the average carbon tax.

Carbon taxes are likely to become adopted by many other countries, as well as private institutions, as the threats posed by climate change continue to rise.

In its latest report, the United Nations Intergovernmental Panel on Climate Change reaffirms that climate-related risks to health, livelihood, food, water, security and growth are projected to increase with a global warming of 1.5 C above preindustrial levels – and that severe and integrated policy interventions are required to limit this situation.

The report stresses the need for well-developed emission targets and much lower carbon intensity rates. It also recommends much higher carbon prices than the ones observed in real markets. As an example, the report says that a price for carbon emissions as high as $27,000 per ton of carbon dioxide may be needed in 2100 to limit global warming to 1.5 C.

A Necessary Tax Reform

With the sharp decline in international oil prices that started in 2014, oil tax revenues for the Colombian government were expected to dramatically fall from 3.3 percent of the country’s gross national product in 2013 to virtually zero in 2016, according to the Ministry of Economy of Colombia. This is almost 20 percent of the country’s total income.

Thus, in December 2016 the Colombian government enacted tax reform through Law 1819. The goal of this reform was to prevent oil-tax revenues from negatively impacting the country’s budget through simplifying the tax code, preventing evasion, and modernizing regulations.

The tax reform was seen as needed because of the potential revenues it could generate. In addition, the reform was presented as a way to enhance Colombia’s nomination to the Organisation for Economic Co-operation and Development.

Javier Sabogal, cabinet advisor to Colombia’s Ministry of Economy, said that “It was key to have alternatives [during the negotiation process]. There were unprecedented budget constraints for the country. Many proposals to increase taxes were evaluated.”

The Colombian government evaluated increasing or creating taxes for a wide range of concepts. Among the alternatives were carbon emissions, plastic bags, general sales, coal mining, and other options.

“Among the many things that were proposed, the increase in the national sales tax attracted most of the attention, and we knew it,” Sabogal said. Increases in sales taxes are usually felt by most people in an economy, so they usually attract attention from the media and the public. “That situation helped us to push forward the new taxes on carbon.”

“Nevertheless, not all of the original taxes were approved. For example, the coal industry [was] left out of the reform,” Sabogal said.

The Colombian Carbon Taxes

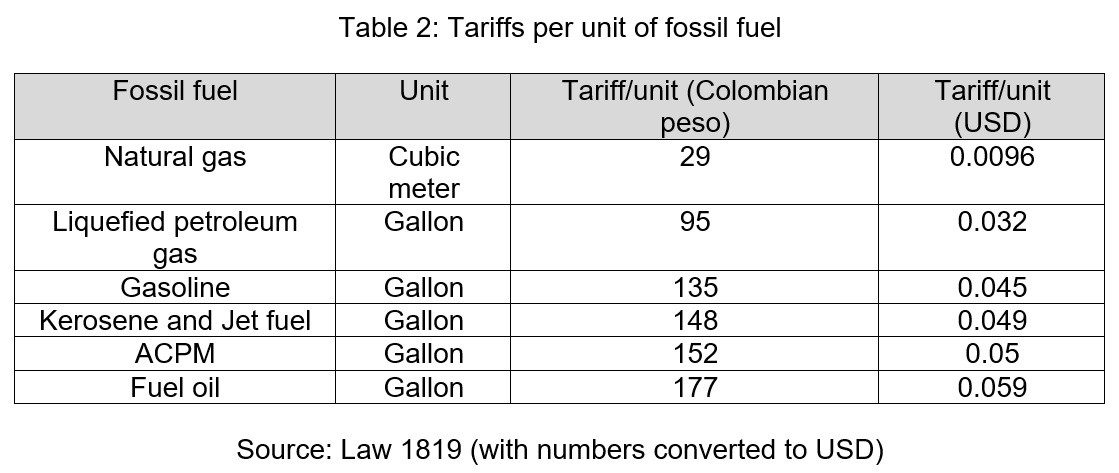

Due to this reform, the Colombian new tax code now directs that taxes be imposed in relation to the amount of carbon in fossil fuels, specifically gasoline, kerosene, jet fuel, diesel fuel (ACPM), and fuel oil. Liquefied petroleum gas is also taxed for its carbon content, but only when sold to industrial users.

The action that generates the carbon tax is the sale of any of these fuels within Colombian territory. Both producers and importers are responsible for collecting the taxes. The tariffs impose an amount of about $5 USD for each ton of carbon dioxide generated by fossil fuel combustion, adjusted by inflation each year. The tax will be capped at a maximum rate of $10 USD per ton of carbon dioxide.

The tariffs were designed so that fossil fuel prices in Colombia would not be distorted to a great extent. For example, at current prices, tariffs represent less than 2 percent of the price of 1 gallon of gasoline or ACPM diesel.

In Colombia, average monthly sales of gasoline and ACPM diesel have been of approximately 150 and 160 million gallons respectively. This means that almost $200 million USD could be generated in a yearly basis from gasoline and ACPM diesel sales.

According to the government’s initial plans, the revenues generated by these taxes would be directed to the “Sustainable Colombia Fund.” These revenues are intended to be directed toward resolving coastal erosion, conservation of water sources, and ecosystem protection, among other uses. Later, during the peace process, the fund was renamed to “Colombia in Peace Fund.”

Another interesting feature of the tax reform is that it introduced tax breaks for companies that neutralize their carbon emissions. In this way, companies can now be certified as carbon-neutral. Since taxes are charged to wholesale distributors, companies that purchase fossil fuels are allowed to present a request for tax breaks if they have invested in mitigation projects.

The Heritage Program

Colombia is one of the most biodiverse countries in the world. It is ranked first internationally in birds and orchids and second in plants, amphibians, fish and butterflies, according to the Ministry of Environment and Sustainable Development’s 2015 update report to the United Nations Framework Convention on Climate Change.

On May 2018, Colombia’s former president Santos announced in an international event that 5 percent of the carbon taxes would be directed to the Herencia Colombia (Heritage Colombia) program, which aims to protect and conserve 20 million hectares of Colombia’s natural areas. This program is intended to serve as a model of long-term finance for conservation of natural protected areas.

The Challenges that Remain

“Almost a third of the carbon tax revenues has been subject to tax breaks, which is great news if these breaks have a clear and positive impact. So, now the focus of the government has shifted to making the mitigation efforts more transparent and adequately certified,” Sabogal said.

Another challenge is addressing the main drivers of Colombia’s carbon emissions: deforestation and energy production. According to the Ministry of Environment and Sustainable Development’s Institute of Hydrology, Meteorology, and Environmental Studies, carbon emissions in Colombia are mainly driven by transportation technology, energy production, and deforestation.

While the energy sector constitutes 44 percent of Colombia’s emissions inventory, another 43 percent is represented by the agricultural sector. In the energy sector, land transportation and energy production represent 33 percent and 23 percent of the sector’s emissions, respectively. In the agricultural sector, land-use changes for grassland represent 35 percent of the sector’s emissions and methane emissions from cattle 28 percent.

Last, Colombia has to plan in advance what to do when coal exports decrease in the future. In this scenario, cheap coal will be used to generate electricity and Colombia’s emissions will probably spike. A tax on coal may be insufficient to mitigate this new source of emissions.

Sabogal said, “There are countries that will stop or slow their coal acquisitions in the near future. This will impact Colombia’s exports, as it is the sixth largest coal exporter in the world. As exports slow down, the remaining coal will probably enter our energy matrix and produce dirty energy. A tax on coal was not possible at the time of the reform and is still difficult to implement, but we will have to find ways to deal with this situation.”

To comment on this article, please post in our LinkedIn group, contact us on Twitter, or use our contact form.