Using Financial Models Sets up Land Trusts for Success

Financial modeling is an emerging application for land trusts. It could make a great difference in their ability to forecast and plan for various future financial scenarios. At this year’s Land Trust Alliance Rally conference during the “Your Future: Financial Modeling for Long-Term Stability” workshop, the Dutchess Land Conservancy of Dutchess County, N.Y., presented a financial model it developed.

Rationale for Using a Financial Model

A land trust’s board and leadership teams need to have a good handle on its financial status and trends to enable well-informed decision-making. These decisions may affect the land trust’s future financial performance. Employing a financial model is one method of outlining paths to stability and using data to justify decisions.

Yet many land trusts struggle with undertaking 360-degree analyses of their finances. In particular, smaller land trusts may not have the staff time or expertise to develop a financial model. However, land trusts must plan for long-term financial sustainability to ensure they can fulfill their obligations to steward their land holdings and oversee their conservation projects.

According to the Land Trust Alliance presentation by volunteer Bryant Seaman, Board Chairman Rebecca Seaman, and President and CEO Becky Thornton, land trusts must consider the question, “How do we know what we’ll need and how to get there when reality doesn’t match best laid plans?” Financial models provide informed contingency plans to address this scenario.

Development of the Dutchess Land Conservancy’s Financial Model

The creation of the conservancy’s model was spurred by the fact its previous financial forecasting solely consisted of a one-year budget, according to its presentation. This left the land trust’s board and management team wondering whether it could sustain its recent performance and any potential added volatility over a longer time frame.

Various questions were highlighted during the presentation. “What happens if we lose a chunk of our major donor base?” “How big does our endowment need to be to cover all expenses with market return alone?” “Will taking on this major project spiral costs out of control for the next few years?”

Seaman, who developed the model, said that the team created it based on an analysis of the land trust’s historical financial trends. These trends were then applied looking forward for five-plus years.

This method allowed lessons learned from past financial situations to be retained and future organizational goals to persist. The presentation said that maintaining this consistency in organizational goals helps to cultivate donor loyalty. Likewise, ambiguity in setting an appropriate financial response to a situation can be avoided through informed analysis of precedents.

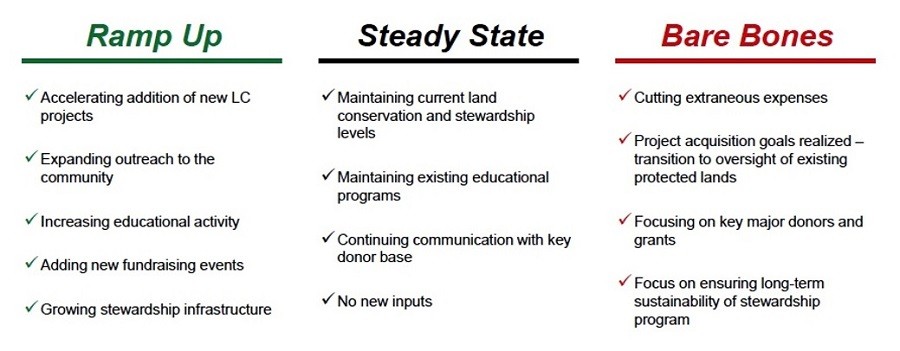

The model provides three projection scenarios: growth, steady state, or decline. These help the organization understand its future financial performance. The model also includes information related to the organization’s endowment balance.

These three projection scenarios were developed in response to fundamental questions. For instance, the growth projection was tailored to determine whether taking on additional projects would make costs unbearable. As such, the projection modeled an increasing project workload.

The steady-state projection was based on the fact that costs continue to rise, so the land trust needed to know whether it could be sustainable at its current state. For the steady-state projection, the model used current projections.

Finally, the decline (or “bare bones”) projection examined whether the land trust could adapt if a large portion of its fundraising disappeared. In other words, the projection modeled a transition to stewardship of existing holdings alone rather than addition of new protection projects.

The figure below, which was shown in the presentation, illustrates typical characteristics that would fall under the three projection scenarios.

As previously mentioned, the model was informed by examining historical financial data for the organization. This step was critical in assuring the accuracy of the model. The conservancy presentation suggested that other land trusts looking to develop a similar model should mobilize their organizations to focus on financial reporting.

According to Seaman, accurately reporting financials builds more robust historical data sets. It’s also important to maintain consistency in reporting across periods, thus ensuring that analysis and the basis for projections are meaningful.

While working to maintain this consistency, the conservancy struggled with variations in annual budgets over the years. Seaman said that instances of project grants, fiscal carryovers, special gifts, and tracking changes skewed results.

To resolve this, Seaman said, the conservancy standardized its classifications of what fell within the categories of income and expenses. It looked at data for the past 10 years to better understand fluctuations through past economic cycles. It also quality-controlled the data to remove one-time items that may skew the data and to ensure there was no reclassification of different types of income over the years.

Analysis of the Model’s Results and Implications for the Future

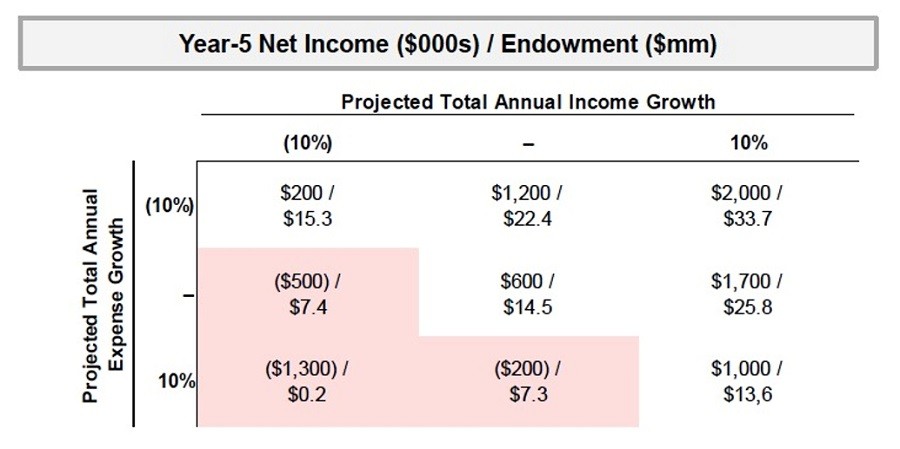

Looking at the model’s results, land trusts can see critical information regarding the organization’s net income and endowment balances in the next five or ten years. They can then answer the question: “If we operate in this scenario, where will net income and the endowment balance be in five or ten years?” The illustrative example from the presentation, shown below, provides a simplified output from the model.

Overall, a financial model can provide the support needed to make the case for initiatives to ensure future longevity. These may include raising capital for specific needs, generating broad community support, and building stronger relationships with current and potential donors, according to the conservancy.

The presenters said land trusts can begin to include modeling in their financial-review process by taking the following steps. Land trusts should collect key data inputs, classify data clearly, and consider scenarios specific to their organization. Before analyzing results, it can be helpful to look closely at historical patterns to inform projection results.

Further, when one is analyzing the model’s projection results, it’s important to tailor its outputs to answer board questions, inform management decisions, and facilitate organizational goals. Variables can be adjusted based on different questions, so iteration is key for continual learning.

Dutchess Land Conservancy created an easy-to-use shell version of its model. Now, other land trusts can use the shell to insert their organization-specific parameters and historical data to generate relevant results without having to develop a model from scratch. To request a copy of the shell model, please contact the conservancy for more information.

Note: Land Trust Alliance has donated to

The practice of raising and managing capital to support land, water, and natural resource conservation.

Network.To comment on this article, please post in our LinkedIn group, contact us on Twitter, or use our contact form.