Seeding New Capital: Understanding Private Financing for a Regenerative Agriculture Future

Author: Will Slotznick

Photo: Tim Mossholder

US private investors are increasingly attracted to regenerative agriculture for its economic potential and observed resistance to broader market contractions. With approximately $50 billion deployed in US sustainable farmland and regenerative agriculture projects today, this represents a significant capital infusion from the private sector. It’s also good news for land trusts and conservation groups, who can serve as partners in expanding coverage and advancing the regenerative field.

The Conservation Finance Network (CFN) last wrote about regenerative agriculture in April 2020, introducing the sector's opportunities and obstacles ahead of uncertain economic times. Despite the market shocks of the ensuing four years, the data indicates that consumer, corporate, investor, and government interest in the regenerative space has only accelerated.

Below is CFN’s rundown on financing trends in US regenerative agriculture in 2024, gathered through interviews with more than a dozen expert investors, advisors, and conservation practitioners. Geared towards conservation practitioners, this brief re-introduces the primary components of regenerative agriculture, outlines the positive investment case for regenerative land management, spotlights the investment firms and other ecosystem players allocating capital today, and categorizes promising opportunities for cross-sectoral engagement.

The public knowledge base on financing for sustainable agriculture is also expanding, and we include links to the most recent guides and publications for individuals eager to learn more. In particular, we recommend viewing this complementary study from the Yale Center for Business and Environment, which examines the barriers that farmers and financial institutions face in funding a regenerative transition.

Establishing Regenerative Agriculture as a Sector

Arguably the trickiest part of “regenerative agriculture” is understanding how to define the sector -- evaluating what does or does not ‘count’ as a regenerative investment. In general, regenerative agriculture represents a land management philosophy, a menu of on-farm techniques, and an index of economic and ecological outcomes.

The Natural Resources Defense Council (NRDC) refers to regenerative agriculture as a “holistic set of principles” that can guide landowners in integrating profit generation and environmental stewardship. In contrast to conventional agriculture, which typically prioritizes short-run economic returns at the risk of long-term resource depletion, regenerative management emphasizes restoring soils and waterways to ensure the resiliency and longevity of working lands.

Building on that definition, agronomists and soil scientists have distilled the specific techniques that will help growers minimize their impacts on soil, water, and the environment to ensure the longevity of farmland resources.

Farm managers who are practice-oriented track the inputs and activities involved in regenerative production. In a row cropping system, for example, regenerative activities might include reduced seasonal soil tillage, minimal application of chemical-based fertilizers and pesticides, improved water use efficiency via precision irrigation, and diversified crop planting via intercropping and cover cropping. In a livestock grazing system, the activities might include rotational grazing, manure management, and nutrient-rich feed provision.

Other land managers focus on the outcomes of regenerative interventions, which can include higher soil organic matter, reduced erosion, reduced chemical runoff, stability in yields, and enhanced biodiversity. These practitioners invest in soil testing, ecological surveys, economic studies, and other measurement techniques to assess and report changes in regenerative outcomes.

In contrast to the carefully regulated USDA National Organic Program, no single index or certification governs regenerative agriculture practices. Organizations like the Rodale Institute, Regenefied, and Leading Harvest have each introduced frameworks to guide practitioners, but there is not a consensus on which is the most widely applicable. Some asset managers adopt these frameworks directly, some customize and combine them, and others develop their own based on specific investor requirements and organizational values.

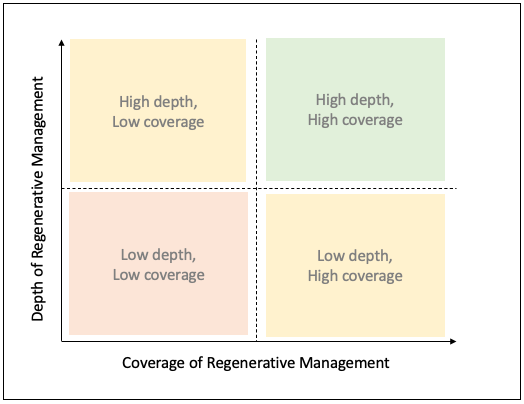

Without a universally accepted index for the inputs, outputs, and thresholds constituting regenerative management, regenerative investments are best understood on a spectrum of scale and depth (Figure 1). In one corner of this matrix are land managers who implement multiple techniques and seek strong ecological outcomes over a limited amount of acreage, and at the other end are managers who deploy fewer practices and seek moderate outcomes over a larger amount of acreage. Both approaches can yield potentially significant conservation outcomes.

Figure 1: Categorizing regenerative agricultural investments

Why Regenerative Agriculture is a Promising Asset Class

Farmland is a type of real asset that generates economic value from a combination of leasing agreements, seasonal crop and livestock production, and appreciation of the underlying land value.

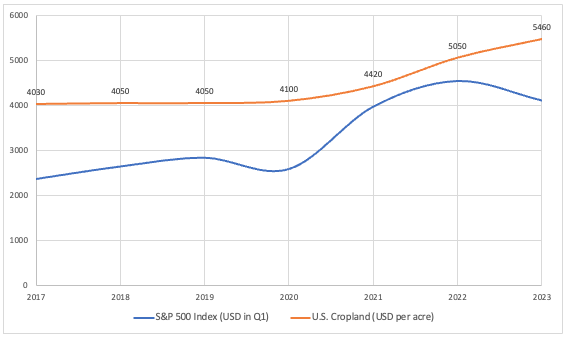

Since the 1990s, US farmland, in general, has performed well in terms of average returns to investors. The NCREIF Farmland Property Index, which was established in 1991 and tracks the growth of the largest US farmland owners, reported an 11.4% average annual return over the last 25 years. The returns from the S&P 500 index over that period were approximately 9-10%, by comparison. In addition to strong financial returns, US farmland values have generally been non-volatile and non-correlated to the overall stock market, allowing the asset class to weather several economic shocks. The recent trendlines in Chart 1 illustrate this advantage: when the stock market dipped precipitously in 2020 due to the global pandemic, the price of US farmland continued to rise. Lastly, US farmland has consistently proved a reliable investment because agricultural commodities keep pace with the consumer price index, plus global demand for food production typically increases every year.

Chart 1: US Cropland versus S&P 500

Source: INX S&P 500 Index, USDA – NASS; Adapted and modified from “Investing in Regenerative Agriculture” (SLM Partners, 2024).

For these three reasons – strong returns, low risk, and inflation resistance -- institutional investors such as private equity funds, pension funds, endowments, and family offices have made US farmland a growing element of their diversification strategies. According to NCREIF’s quarterly farmland index, the number of assets owned by these types of investors rose by 231% between 2008 and 2023, and the average cropland price achieved a record of $5,460/acre in 2023.

A portion of that allocation is increasingly flowing toward regeneratively managed farmland. In a recent white paper, Paul McMahon, Managing Partner of the investment firm Sustainable Land Management (SLM), coined the term “Regenerative Edge” to describe why:

“Regenerative agriculture [compared to conventional agriculture] can be more profitable and deliver superior risk-adjusted financial returns to farmers and investors... These superior returns will come from one or more levers: higher yields, lower operating costs, higher output prices, new environmental payments (such as carbon) or more stable operating results (i.e. resilience)... Investing in farmland that is managed regeneratively has added benefits and can provide a higher return for investors (Alpha)—in the right context, it can add 1-3% to an annualized internal rate of return.”

Several agronomic studies are underway to empirically demonstrate the “Regenerative Edge,” including a research partnership between SLM and EcoHarvest to measure the carbon payment potential from regenerative interventions. Nonetheless, McMahon is clear that the Regenerative Edge is not easily replicated from one property to another. Delivering an economic premium is deeply tied to ecological context, crop type, and input costs (including labor), which means the algorithm and timeline for producing desired investment returns will typically differ across agricultural landscapes.

Take, for example, a mid-sized row cropping operation in Minnesota that wants to reduce its agrochemical usage and reap the associated savings. If the owner eliminates fertilizer applications all at once, the farm risks short-run yield losses that jeopardize cash flows to creditors and/or shareholders. However, by instituting changes on partial acreage and securing extended financing windows, the owner can re-stabilize yields with lower inputs costs over the long-run.

A growing cadre of fund managers, SLM among them, is driving forward the economic case and strategy for regenerative agriculture. By finding investible opportunities, crowding in private funding, managing properties sustainably, extending ownership periods, and publicizing the outcomes, these ‘sustainable fund managers’ aim to deliver the Regenerative Edge and propel interest among large investors.

In practice, fund managers often blend capital from a range of ‘impact-first’ to traditional investors when they establish regenerative portfolios. Impact-first investors, like donor-backed nonprofits that can accept lower rates of return or make riskier investments, might be willing to anchor a new and untested fund in return for high conservation benefits. Traditional investors, like pension funds or university endowments that expect competitive returns and good security, might participate in subsequent and larger-ticket funds that lead to greater scale.

Spotlighting Fund Managers in US Regenerative Agriculture

The number of new entrants to the sustainable real asset management space has grown significantly over the last two decades. Ethan Soloviev, CEO of the sustainability rating company HowGood, has compiled and tracked over two dozen equity investors in this open-source workbook, last updated in Q4 2023.

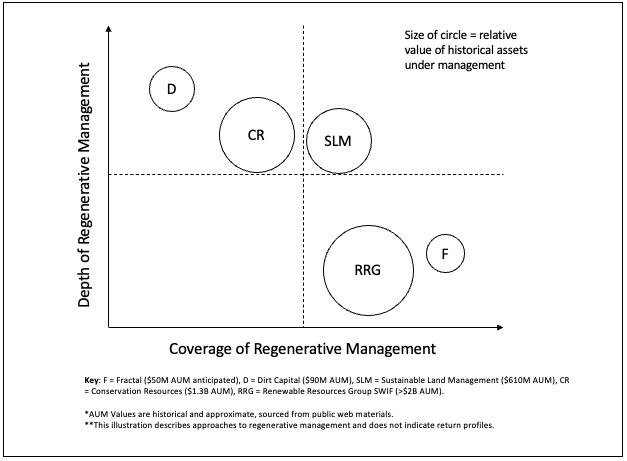

In Figure 2, we highlight a representative sample of fund managers according to their investment size plus the depth and coverage of their regenerative strategies. CFN spoke with and reviewed public materials for each of these funds in its research for this piece.

Figure 2: Categorizing real asset managers by strategy

The fund managers we showcase employ unique investment strategies, including how they approach property ownership, partnerships, and social and environmental outcomes measurement.

Dirt Capital Partners

Dirt Capital Partners is a 10-year-old fund manager with approximately $40 million AUM invested in a diversity of farm types in the US Northeast and Mid-Atlantic, plus a planned $50 million nationwide expansion including California, the Midwest, and the Pacific Northwest. The firm co-invests in new land acquisitions and agricultural infrastructure with sustainability-oriented farmers, providing them the time, resources, and flexibility to expand their operations. In many cases, these farmers do not have immediately available capital to purchase land outright, so Dirt Capital enables access to farm ownership where it might not otherwise be possible.

Dirt Capital has designed several strategies to grow its portfolio and assist farmers. In some instances, the fund manager will own a property in whole and establish leasing terms with a farmer until they can buy it outright over a multi-year period. In other cases, the purchase is a joint venture between the farmer and Dirt Capital, where both parties enjoy returns for an established tenure.

Dirt Capital also engages with land trusts to sell conservation easements on portions of purchased farmland, both to provide early returns for Dirt Capital’s investors and safeguard properties for “long-term health and regeneration,” as described in its 2024 impact report. Serving as a bridge between farmers, conservationists, and private capital sources, Dirt Capital has 18 conservation easements completed or in process.

A conservation impact plan is the cornerstone of every property and farmer relationship at Dirt Capital. Drawing from leading frameworks in the regenerative sector, the firm revamped its impact measurement system in 2023 to focus on ecological stewardship, farmer equity, wealth building, and community benefits equally. Among the outcomes it showcases are:

-

74% of active portfolio projects deploy cover cropping

-

67% of active portfolio projects practice conservation irrigation

-

$8.1 million have been invested in projects with BIPOC farmer ownership

-

$15.7 million have been invested in projects with farmers under the age of 40

Altogether, Dirt Capital hopes that access to land, flexible capital, and improved farm management will create security and economic upside for underserved farmers and local communities in the US.

Fractal Agriculture

Fractal Agriculture, a newer asset manager, is raising a $50 million fund focused on commercial-scale row crops in the Midwest and Great Plains. Unlike some of its peers, Fractal concentrates on a minority equity investment strategy to reduce the cash burden of sustainability-oriented farmers. Fractal’s passive ownership stake will ideally transfer more decision-making power to growers plus help them enjoy greater upside and lower transaction costs when raising capital to expand their operations. Co-founder Ben Gordon remarked when describing Fractal’s approach, “I want to put all my chips next to a local expert: the farmers.” The fund will seek 10-year investment periods for each property, after which the co-investing farmer may buy out or roll over Fractal’s position.

In terms of measurement, Fractal’s impact pillars focus on the outcomes of regenerative crop management, such as improved water-holding capacity and reduced erosion of soils, that will improve the long-term resilience and productivity of farmland. The new fund may also offer discounts on financing (e.g. reduced payments to investors) based on growers’ achievements in those dimensions. By allowing farmers to select locally appropriate practices rather than prescribing activities, Fractal hopes to promote accessible and context-appropriate solutions that incrementally advance sustainable farming at a systems level. A leading environmental NGO is slated to be a technical partner and impact manager on Fractal’s first fund – highlighting yet another position for conservation groups in sustainable asset management. Fractal is putting 50% of its potential carried interest at risk for its ability to achieve portfolio-level impact targets.

Fractal Agriculture is poised to resolve an interesting gap in the broader regenerative marketplace. By providing catalytic, de-risking equity to row crop growers transitioning into climate-smart practices (as opposed to smaller, highly experimental farms), Fractal seeks to earn strong returns for its investors while galvanizing institutional confidence and resources towards regenerative agriculture at scale.

Sustainable Land Management

Sustainable Land Management (SLM) has been operating since 2009 and is a recognized veteran in the sustainable agriculture ecosystem. SLM manages $610 million in assets globally and primarily works with institutional investors who seek market and above-market returns. SLM takes a majority ownership stake in its properties, contracts skilled farmers to bring its lands under regenerative management, and strategically diversifies across cropland, grassland, and forestland in the US, Europe, and Australia.

Given the rising costs of farm labor in developed markets, SLM sees particular value in investing in capital equipment on its owned assets to support its regenerative thesis. Equipment can include mechanized weeding systems to replace chemical treatments and drone and surveillance imaging to improve nutrient and water use.

Renewable Resources Group

RRG Capital Management (RRGCM), a certified B-Corporation asset manager, pursues a majority ownership strategy and leverages cross-sectoral partnerships to drive strong economic and sustainability returns.

In collaboration with NatureVest (the impact investment arm of The Nature Conservancy), RRGCM operates the Sustainable Water Impact Fund (SWIF), which includes more than ten farms, water banks, renewable energy sites, and operating companies totaling over $877 million across the Western US, Peru, Chile, Uruguay, and Australia. A large portion of SWIF’s farmland assets are focused on the fruit and specialty nut sectors.

The Nature Conservancy supports SWIF in the design, delivery, and measurement of conservation interventions on acquired land, including wetland restoration, biodiversity protection, and improved land management. RRGCM and TNC also sell conservation easements on portions of SWIF properties with high ecological value to local governments and land trusts for permanent protection. The SWIF platform has completed or is in the process of completing easements on six of its properties totaling 22,000 acres.

Overall, SWIF categorizes its impact into five domains: climate mitigation, sustainable agriculture, water stewardship, quality jobs, and good governance. Per its latest impact report, reported achievements in 2023 included:

-

2.3 GWh of renewable energy generated on SWIF properties

-

100% of assets pursue responsible nutrient management

-

90% of assets pursue efficient irrigation management

-

100% of year-round production workers provided healthcare

SWIF not only provides a model for public-private collaborations in agricultural financing, but the fund illustrates how a well-managed, mixed-asset portfolio with a strong impact framework can drive broad sustainability results across water, agriculture, clean energy, and habitat protection.

Conservation Resources

Conservation Resources is an impact-focused timber and farmland manager with 20 years of investing experience, $1.3 billion in historical AUM, and 189,000 hectares of land permanently protected to date. Conservation Resources’ strategy involves long-term hold periods for its assets, and the firm invests with a 100% commitment to regenerative and/or organic production.

Among peer asset managers, Conservation Resources stands out for its rigorous approaches to impact measurement and verification, guided by third-party certifications that focus on both the inputs to and outcomes of regenerative agriculture. This is a strategy that resonates with Conservation Resources’ mix of impact and institutional investors, and the firm has found that committing to sustainability boosts (not detracts from) economic returns. By instituting practice changes on its properties, Conservation Resources regularly unlocks unique conservation transactions — including easements, nutrient credit programs, mitigation banking, and organic premiums — to add value and to seek above-market returns for its investors. Conservation Resources’ long-standing track record exemplifies how one can achieve economic and environmental returns in tandem.

Other Investors: Retailers and Consumer Packaged Goods Companies

Alongside the types of investors described above, Food Retailers and Consumer Packaged Goods (CPG) companies represent an increasingly important stakeholder group to the regenerative agriculture transition. Given their deep influence across agricultural value chains, these institutions are serving as capital providers for sustainable land management, investing in clean agri-technology on farms, sponsoring carbon farming projects, and building markets for organic or regeneratively-grown products. CPGs are willing to do this because sustainable agriculture offers their businesses intrinsic advantages. Rising consumer appetite for ethically sourced goods, broader public attention to corporate sustainability, and worsening climate risks in supply chains are collectively driving multinational companies towards regenerative management across their agricultural footprints. We highlight two such companies below.

Danone

Danone is driving a shift in value chains and procurement in the US dairy sector. Since 2016, the firm has operated a multi-million dollar fund to support contracted US dairies with on-farm “health improvement plans” that integrate regenerative practices spanning carbon reduction, water conservation, and biodiversity promotion. Danone’s program also supports dairies in financing high-cost, climate-smart technologies like solid-liquid manure separators that process manure into fertilizer while recycling clean water back into farm operations. With some farm partnerships, Danone is paying for regenerative practices in exchange for securing ecosystem assets – such as water, carbon, and biodiversity credits – that the company uses to reduce its annual environmental footprint via a process called ‘insetting’.

PepsiCo

PepsiCo has mirrored this work for the US row crops sector. In 2023, the snack and beverage multinational announced a landmark $216 million multi-year investment in partnership with the Practical Farmers of Iowa, the Illinois Corn Growers Association, and the Soil and Water and Outcomes Fund (SWOF) to expand regenerative management across three million acres of corn, soy, and potato plantations by 2030.

Since its conception in 2020, the Soil and Water Outcomes Fund has worked with growers across several corporate supply chains to introduce cover cropping, reduced tillage, and extended crop rotations in farm operations – cumulatively on over 540,000 acres to date. The organization measures and verifies the associated ecological outcomes, and participating landowners receive financial incentives for their conservation achievements.

PepsiCo’s new investment will support improved practices on 1 million additional acres of land – equal to PepsiCo’s entire agricultural footprint -- and the Soil and Water Outcomes Fund will generate and transact ecosystem credits to PepsiCo as ‘insets’ based on the outcomes. PepsiCo’s investment in this arena is one of the largest among peer CPGs.

Blending Public and Private Funding

Private-sector actors—both asset managers and corporate off-takers—are pooling capital for sustainable agriculture in an increasingly favorable policy environment. The last two years presented watershed moments for public funding of climate-smart agriculture in the US, amounting to billions of additional dollars in the market to de-risk, catalyze, or supplement private sector efforts toward regenerative systems.

Partnerships for Climate-Smart Commodities

In 2022, the US Department of Agriculture (USDA) announced investments of $3.1 billion for 141 projects supporting private farmers, ranchers, and forest landowners with technical, measurement, and financial assistance on climate-smart production practices.

The grants aim to advance the market for sustainable commodities, open new revenue streams for managers and landowners, and, consequently, expand the coverage of sustainable management over more than 25 million acres of working land. The full list of funded projects includes a diversity of cross-sectoral and blended finance collaborations.

The Reduction Fund

In April 2024, the Environmental Protection Agency (EPA) released an additional $20 billion through the

(GHG)

Reduction Fund to stimulate market investments in clean energy and other climate solutions. The Fund was divided into two components: the National Clean Investment Fund (NCIF) and the Clean Communities Investment Accelerator (CCIA).In March 2024, the NCIF announced awards totaling $14 billion to coalitions, including Climate United and the Coalition for Green Capital, through which project developers can apply for reimbursement funding. Coalition leaders are eager to include nature-based solutions among qualifying projects, presenting a historic opportunity for regenerative agriculture managers to retrieve zero-cost capital as they scale their operations.

According to Maggie Monast, one of the architects of the Agriculture Finance Sustainability Coalition, a Climate United partner, funding from the National Clean Investment Fund could help de-risk and catalyze replicable, scalable, and equitable financial solutions that accelerate climate-smart agriculture implementation. “The EPA’s announcement is a major step forward and will generate benefits for farms, ranches and rural communities across the nation,” she said in a press release.

Moving Forward: Opportunities for the Non-profit Conservation Sector

The flow of private capital toward sustainable farmland is on a positive trajectory for the coming decade. Encouraged by growing retailer interest plus historic public funding, asset managers will continue to find and unlock the economic opportunity in regenerative agriculture.

Still, the investors and managers we spoke with were clear that a regenerative transition demands a “whole of system” approach, including active involvement from the nonprofit sector. Here are five ways they suggested conservation organizations can engage with private capital providers and ensure social and ecological outcomes are achieved:

-

De-risk new funds: Deploy patient capital to anchor new, experimental, or higher-risk regenerative agriculture funds and businesses. By offering runway to novel approaches and broadcasting their impact, conservation nonprofits can help attract institutional capital at scale in the future. Groups like NatureVest (The Nature Conservancy’s impact investing arm), Conservation International Ventures, and the Acumen Resilient Agriculture Fund are demonstrating the benefits of this function, and there is ample need for more impact-first financiers in the ecosystem.

-

Provide bridge financing: Deploy low or zero-interest bridge loans to regenerative project developers while they await disbursements from public grant awards meant to support their adoption of regenerative agricultural practices. LegacyWorks Group has detailed what a revolving loan facility with this purpose looks like.

-

Support conservation easements: Collaborate with agricultural real asset managers to establish conservation easements on properties with high ecological value. Land trusts have worked with managers like Dirt Capital, RRG, and Conservation Resources to identify appropriate places for conservation, navigate legal and jurisdictional processes, fundraise for easement transactions, and manage the conserved area post-sale.

-

Advance scientific knowledge and innovation: Conservation nonprofits can drive research partnerships between investors, farmers, and universities to advance the evidence base on regenerative agriculture’s modalities and outcomes. The Foundation for Food and Agriculture Research is a major actor in this space. Environmental groups can also support early-stage regenerative innovations—for example, biological fertilizers, precision irrigation, carbon credit pilots, and low-tillage machinery—in ways that private capital might find too high-risk. WWF Impact, the venture arm of the World Wildlife Fund, is actively scoping this arena.

-

Convene on standards: As described in the introduction to this report, an enduring challenge for the regenerative agriculture sector is a lack of consensus on standards and definitions. This gap has resulted in too many competing frameworks that tend to obfuscate when genuine work and results have been achieved. Within this space of uncertainty may lie an opportunity for large-scale or coalition-based organizations – such as the Nature Conservancy, the Global

Investments that combine financial returns with social and/or environmental benefits.

Network, or the World Business Council for Sustainable Development – to convene an adaptive solution that affiliated organizations can utilize with greater confidence.