April 2024 Conservation Finance Roundtable Recap

In late April, the Conservation Finance Network hosted our 12th annual Conservation Finance Roundtable at Duke University’s Nicholas School of the Environment in Durham, North Carolina, with support from the Connecticut Green Bank, the Z Smith Reynolds Foundation, and Danone. Nearly 100 attendees came together from across the country to participate in a series of sessions on topics ranging from nature-based solutions and interim finance to new trends in impact investment and efforts to increase access by small and underserved landowners to ecosystem markets.

Key themes that emerged from the two-day Roundtable include:

- To ensure that conservation investment benefits accrue to all, we must change how we work in and with communities, particularly those that historically have not benefitted from conservation funding.

- It will take a lot of “little engines that can” doing place-based, community-specific work to create lasting social and environmental impact at scale.

- There is a growing need for flexible, low-cost capital to bridge funding delays for land acquisition and restoration projects.

- The conservation community needs to move from “funding to financing.” The Reduction Fund (GGRF) and other recent federal funding awards create this opportunity. The GGRF, specifically, creates opportunities not just to fund projects that address climate change, but to create and fund the climate finance institutions of the next 50 years. The conservation community needs to act now in order to ensure that today’s investments transform how we do conservation in the future.

In her keynote talk, Lydia Olander (Duke University), just coming off a two-year stint at the White House Council on Environmental Quality, detailed her and her colleagues’ work in driving awareness of and accounting for nature-based solutions in Federal processes and institutions. She issued a ‘call to action’ for practitioners in the room to continue building the case for the economic and environmental dividends that nature-based solutions can yield on the ground.

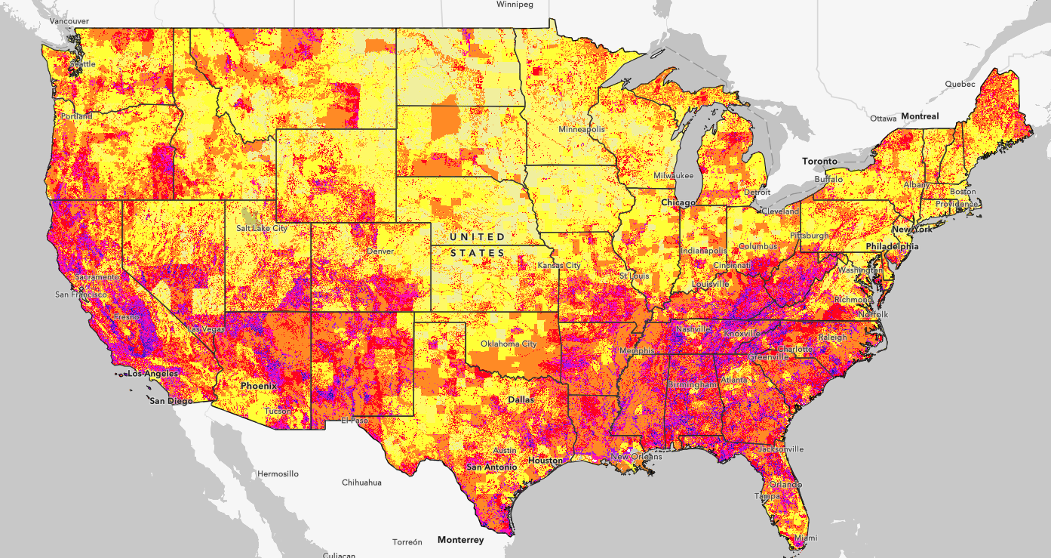

Mikki Sager (Justice through Food) facilitated a panel focused on how to help small and underserved landowners access ecosystem markets with panelists Nikola Smith (U.S. Forest Service), John Fenderson (Croatan Institute), and Danyelle O’Hara (Center for Heirs’ Property Preservation). Describing small and underserved landowners as “often thought about but overlooked,” Mikki Sager showed a map of the U.S. that equally weighted biodiversity, climate, and equity. This map highlighted overlaps between these factors in the U.S. southeast, southwest, and California. For various reasons, larger landowners and larger parcels are typically prioritized over smaller parcels for conservation actions. Many areas in the U.S. with high biodiversity also have small properties and poor socioeconomic conditions.

The Forest Service described their recent grant program to help small and underserved landowners access ecosystem markets, and Nicola described several of the program’s recent awards. Danyelle O’Hara, whose organization also received a USFS award, described how heirs’ property challenges must be addressed before many landowners can access public and private sources of capital to support land stewardship. A rich conversation followed in which the panelists discussed how practitioners can work more effectively with small landowners to address interconnected social and environmental challenges, and the ways they must change their work to serve community needs.

A panel on public funding described how, with the permanent authorization of the Land and Water Conservation Fund, the Inflation Reduction Act, and the Bipartisan Infrastructure Law, we now have more conservation funding opportunities at the state and federal level than ever before. This session considered how we distribute funds from the federal to the local level, while touching on the following questions: How do we share this new conservation funding in an equitable way? And, how will this funding change not only the way we fund conservation, but also how we finance conservation? One challenge in public funding is the long lag times between when awards are announced and funding received. Panelists, each representing federal agencies, discussed methods for supporting grantees and are working to manage grants in a more streamlined way and reducing lag times.

This set up well a session on interim finance, or bridge lending, moderated by Liz Adams with Lyme Timber’s philanthropic advisory services. Such loans enable various community groups, including land trusts and tribal nations, to undertake conservation activities such as land acquisition and restoration in anticipation of later reimbursement from federal and state funding programs. Liz Adams highlighted the growing necessity for bridge loans due to prolonged transaction durations, which can be delayed by complex appraisal processes and bureaucratic hurdles in receiving funding. These delays have been exacerbated by increasing interest rates that make traditional lines of credit costly, thereby threatening the affordability and feasibility of conservation efforts. There are three primary sources of funding for interim finance: philanthropy, business, and public financing. She also mentioned the role of green banks in securing financing for environmental projects. Many interim finance efforts use "revolving loan funds," which allow for the reissuing of repaid loans to support new conservation projects, thus keeping funds circulating.

Panelists Andy Lacatell (The Chesapeake Conservancy), Alicia Leuba (National Parks Foundation), and Reggie Hall (Legacy Works) each described interim finance structures they are developing to implement their work. The Chesapeake Conservancy is developing an interim loan facility with funding from the state of Maryland’s clean water revolving loan fund. The National Parks Foundation is considering development of a fund to support acquisitions of national park inholdings. And Legacy Works is developing a platform that multiple organizations could house funds on.

A major topic of discussion was the April announcement of the EPA’s $20 billion in

(GHG)

Reduction Fund awards. Matt Carney opened with background on the Reduction Fund’s structure and how the recent funding awards will be allocated across programmatic focus areas and coalitions. Panelists from a mix of Green Banks and CDFIs illustrated how these grants can be leveraged to advance clean energy and nature-based solutions, as well as social and economic inclusion objectives. Attendees brainstormed ways that these funds might be distributed to nature-based projects with quantifiable greenhouse gas emissions reductions, and the role of ‘hub partners’ in distributing funds and aiding quantification efforts.There is urgency to complete projects, sign grant agreements, and develop project pipelines to make good use of the federal resources currently available. The influx of funding and coming election make this urgency palpable. How do we do this while acknowledging that true change “moves at the speed of trust” and requires community building that takes time? This is a potential tension that highlights the need for continuing communication, bridge building, and listening.

CFN’s Executive Director Peter Howell concluded the session by expressing gratitude to everyone involved in the event, including moderators, speakers, and attendees. He specifically thanked Lydia Olander, Richard Mei, and the Duke Nicholas Institute for hosting the Roundtable, and the Z. Smith Reynolds Foundation, Danone, and Connecticut Green Bank for sponsoring. He emphasized the importance of addressing social and economic factors alongside conservation efforts, with a call to action to prioritize community conservation and support distressed communities. He encouraged participants to reflect on the need for cross-sector solutions and contributions from various sectors, and the necessity of integrating these considerations into everyday practices with continued engagement and reflection.

For more on the Roundtable, view the specific session summaries below. The event agenda is available here.

Welcome and Introduction:

Small and Underserved Landowners and Ecosystem Markets

Public Funding Program Updates

Innovation Round Up

- Session Summary by Jasmine Khatri

- Christi Electris's slides

- Carolyn duPont's slides

- Resource: TPL Report on Enhanced Carbon Easements

Interim Finance

Green Banks, CDFIs and Nature Based Solutions

Developing the Pipeline for Nature-Based Solutions

New Developments in Impact Investment

Biodiversity Credits